The Lost Banks of Buxton by David Roberts

On 13 October 2022, NatWest Bank issues a press release regarding the closure of 32 branches including the Buxton branch.

And that really is about, it for the main UK banks in Buxton- with the notable exceptions of the Lloyds TSB and the Building Societies, who continue to hang on

According to NatWest’s Factsheet on the closure, the branch was used by only three people on a regular basis (they don’t define regular) and by 129 business customers. Their figures are that counter transactions declined by 43% in the period 2019 to 2022.

To be fair to NatWest they held out in longer than the rest. Most importantly, it is a personal tragedy for the people who work there and who one assumes get offered the choice of relocating or being made redundant. It is a great inconvenience for the customers, who will now have to drive or get a bus to Macclesfield for counter services. It is also the end of a bit of history, National Westminster Bank in its various guises has been active in Buxton since the late 1870s, so is departing short of the 150th anniversary of doing business in the town.

If you are at all interested in the subject, a small reminder that the British (and therefore the Buxton) taxpayer still owns 48% of NatWest Group. So, this is a short history of banking in Buxton but also a saga which applies to many small British towns, of how historic local British banks, got bigger and bigger, less British and more global and in the end abandoned the communities in which they had been anchored and which helped them grow in the first place

A brief history of banking in Buxton

Although there are mentions of a Buxton and High Peak Bank in the early 1800s – it apparently fails, and Buxton appears to have been without any banks until the late 1850s. After that several banks open, change names and move premises so it all gets a bit confusing,

The original Buxton and High Peak Bank was connected to Jane Austen’s brother Henry Austen. Austen was a London Banker. Actually, he was partner in a firm of Army Agents, Austen & Co, with partner Henry Maunde. At the tun of the 19th century, the Colonel in charge of a Regiment was financially responsible for a Regiment. He appointed a Regimental paymaster who in turn received funds to run the regiment from the Government, through the Paymaster General. This business was transacted through Army Agents. Army Agents also acted as private bankers to the officers of the Regiment and collected money on behalf of “half-pay” officers, who had no active role in the Regiment but were still being paid half their regulation pay. The Agents obviously made a commission on all these transactions. Even more profitable was the commission that Army Agents could make on the buying and selling of Regimental Commissions. In 1806, Austen & Co managed to acquire the agency for the Derbyshire Militia , through its Regimental Colonel, Lord George Augustus Henry Cavendish, brother of the Duke of Devonshire. Austen’s Derbyshire connections continued when Austen & Co was appointed the London Corresponding Bank for the Buxton and High Peak Bank. The Buxton and High Peak Bank was owned by George Goodwin Senior, who had been in the Derbyshire Militia and George Turner Goodwin. The Buxton and High Peak Bank issued its own Bank notes, in the days before that became the monopoly of the Bank of England. It was estimated that around 6,000 Buxton notes might have been in circulation. In 1816, the whole thing collapsed, and Henry Austen’s Banking Empire failed. The Buxton Bank apparently owed him £571 at the time. After the collapse of the Buxton and High Peak Bank, tourists' guides do the 1840s and 1850s suggest that Banking business in Buxton could be done through Messrs. Bright& Sons, a form of jewelers and silversmiths in the Crescent.

Obviously, something more than back-room banking through a jeweler’s shop was needed and during the late 19th Century, a few Lancashire and Yorkshire based regional banks start to open branches in Buxton. As a result of consolidation, these all become parts of larger national banking Groups and the number reduces. With the proposed exit from Buxton of National Westminster Bank, they will all have gone.

The Sheffield & Rotherham Bank (becomes part of Royal Bank of Scotland)

The Sheffield and Rotherham Bank opened in Buxton in 1857. Initially it was a sub-branch of the Branch in Bakewell. It was in Spring Gardens and opened only one day a week on Saturdays (Adams 1860)- Since Buxton had no other banks at this time, it apparently did rather well, so they decided to extend the opening hours. At the Shareholders Meeting on 1 February 1865, chaired by George Hounsfield the following report was read

“In consequence of the increasing business of the Buxton branch, your directors have found it necessary to take more commodious premises and open the bank daily. Thew new bank premises were opened on 1 June last, under the management of Isaac Walton, formerly cashier of the Bakewell branch; the result has been satisfactory” (Banker’s Magazine 1865)

It therefore seems to have moved into 1 The Quadrant in 1864, as a full-time bank. In the 1901 Census, the manager of the bank Mr. Samuel Taylor was living at 1 The Quadrant, so presumably there were living quarters above the bank. In 1907, the Sheffield and Rotherham Bank was taken over by William Deacon’s Bank, a joint-stock bank established in Manchester in 1836 as Manchester & Salford Bank by a group of promoters keen to take advantage of recent legislation allowing the formation of joint-stock banks outside London. From the late 1850s the bank expanded rapidly. Branches were opened in nearby towns, a new banking house in Mosley Street was built in 1862 and several local banking firms were acquired: Heywood Brothers & Co of Manchester in 1874; Hardcastle, Cross & Co of Bolton in 1878; and Clement Royds & Co of Rochdale in 1881. In July 1881 the business was registered as a limited liability company, Manchester & Salford Bank Ltd, and by December 1881 it had a paid-up capital of £757,480.By the 1880s the number of private banks was declining and large clearing banks with London head offices and nationwide branch networks had begun to emerge. In 1890, with 47 branches, the Manchester & Salford Bank took over Williams, Deacon & Co, the bank's London agent. So a good Northern bank takes over a London one! The new bank was renamed Williams Deacon & Manchester & Salford Bank Ltd, and the head office transferred to Birchin Lane, City of London, to retain Williams, Deacon & Co's membership of the London Clearing House. In 1901, the name of the bank was changed to the simpler Williams Deacon's Bank Ltd. In Kelly’s 1912 directory, the only branches listed are

- 1 Cavendish Circus

- 43 High Street

So it appears that sometime between 1901 and 1912 (possibly as a result of opening the sub-branch) the bank moves to 1 Cavendish Circus and vacates, 1 The Quadrant. The enlarged Williams Deacons Bank continued to expand but its commitment to the declining cotton industry after World War I, exacerbated by the effects of the Great Depression, stretched its own finances and encouraged by the Bank of England, Williams Deacon's was acquired by the Royal Bank of Scotland in 1930.

In 1970, when the Royal Bank of Scotland merged its two subsidiaries in England and Wales, Williams Deacon's Bank Ltd. and Glyn, Mills & Co, creating Williams & Glyn's Bank. This in turn was fully absorbed into the Royal Bank of Scotland in 1985 and those historic names disappeared. In 2000, RBS conducted a hostile takeover of NatWest so with two RBS branches and one NatWest, therefore it must have been pretty inevitable that some branches would close. On 7 October 2008, following a 35% plunge in the bank's share price, dealing in RBS shares was suspended. The bank Chairman, Tom McKillop, contacted the Chancellor of the Exchequer, Alastair Darling, to advise that the bank was within hours of running out of money. Darling later observed that

“When dealings in bank shares are suspended it is all over. I knew the bank was finished, in the most spectacular way possible. The game was up. If the markets could give up on RBS, one of the largest banks in the world, all bets on Britain's and the world's financial system were off.”

So grave were the RBS group’s problems, that it was effectively nationalised by the British Government , obviously using taxpayer’s money. After announcing the recapitalisation measures in October 2008, the UK Government purchased an initial tranche of RBS shares in December 2008 totalling £20 billion; it then converted preference shares into ordinary shares in April 2009 and purchased a final tranche of shares in December 2009, taking the final total to £45.5 billion. The public shareholding peaked at 85. 4%

The Higher Buxton branch moved to 22 High Street and became branded as a Royal Bank of Scotland. It closed in January 2019. 1 Cavendish Circus branch also ended rebranded as RBS it closed sometime before 2017 and is now a bar So, toxic had the RBS brand become that in the end it changed its name to NatWest group, in a delicious irony taking the name of the predominantly English banking group which had subjected to a hostile takeover. Williams Deacon's Bank,

Willian Deacons Bank 1 Cavendish Circus 1960s

Williams Deacon’s Bank today – now the Redwillow Bar

London City and Midland Bank (becomes HSBC)

By the time of the 1916 Banker’s Almanac, there is a branch of the London City & Midland bank in Buxton listed at 1 the Quadrant so presumably the Midland Bank leased the premises when Williams Deacon’s left. Midland Bank ticked along as an average British Bank until in 1987, The Hongkong and Shanghai Banking Corporation acquired a 14.9 per cent equity interest. In 1992, HSBC Holdings plc acquired full ownership of Midland Bank. It was one of the largest acquisitions in banking history, giving HSBC the major foothold in Europe, to complement its existing business in Asia and the Americas. Midland Bank was renamed HSBC Bank in 1999 as part of the adoption of the HSBC brand throughout the Group. Because of its ownership of Midland, the Group was required to move its HQ to London. Having become a Global Banking giant HSBC had little interest in a small branch such as Buxton. According to their annual report in 2015

“the Group’s financial performance in 2015 was broadly satisfactory, with reported profit before tax rising 1to $18.9bn. On the adjusted basis used to measure management and business performance, profit before tax of $20.4bn was 7% lower than that achieved in 2014, driven by higher costs and credit charges.”

Meanwhile, the same annual report details on pages 24 to page 34, all the (then ongoing) litigation claims against the bank). From the exotic description of this pending litigation and their global nature (some of which were found unproven), one might reasonably conclude that HSBC had long outgrown providing banking services to the good people of Buxton and indeed the HSBC branch in Buxton closed in 2015. Number 1 The Quadrant is now the Ithaca Greek restaurant, which is possibly a better use.

The Midland Bank

The former Midland Bank now Ithaca Geek restaurant

Crompton Evans Union Bank (becomes NatWest)

As can be seen above, National Westminster Bank in Buxton, already has a long and fairly complicated history, but it has another ancestor in Buxton banking. The Crompton Evans Joint Stock Bank was established in 1877 for the purpose of acquiring the existing sister-banks Crompton, Newton & Co of Derby and Crompton, Newton & Co of Chesterfield, as well as W & S Evans & Co of Derby. Branches were opened at Wirksworth and Mansfield in the first year of operation. The bank acquired the failed Chesterfield & North Derbyshire Banking Co in 1878; Wilson & Son of Alfreton in 1879; and James Taylor & Sons of Bakewell in 1879. There is some real Derbyshire Banking History there. In 1914 the bank was acquired by Parr's Bank. At the time of its acquisition in 1914, the bank was operating 18 branches and 28 sub-branches, including Buxton A second branch of Parr’s bank opened at 47 High Street By 1898, Whitakers Almanac is listing three banks in Buxton

- Crompton Evans Union

- Manchester and County Bank

- Sheffield and Rotherham Bank

It also has a separate listing for Higher Buxton, presumably these were sub-branches.

- Crompton and Evans Union

- Sheffield Rotherham Bank

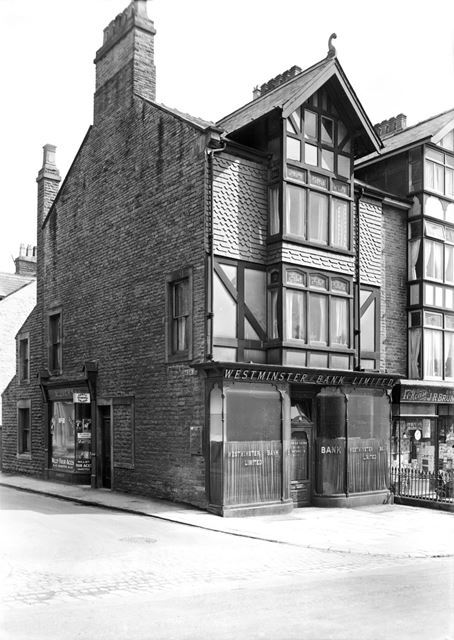

Westminster Bank, Higher Buxton Branch

The former Westminster Bank in Higher Buxton

Both these are listed as new branches in the 1900 Banking Almanac, which being published in 1900, was referring to events in the last couple of years- so we assume they were opened in 1898 or 1899 .

The two former branches of Crompton Evans continued as Parr’s Bank, and then in 1923 simply Westminster Bank, which becomes National Westminster. The history of NatWest then becomes confusing due to the intervention of the Royal Bank of Scotland. As noted, the British Government ended up holding 85% of the shares in NatWest Group (formerly RBS). In March 2002, the Government sold another £1,2 billion in NatWest shares taking its holding below 50%. So, there is no longer a majority state shareholding, but the taxpayers of Buxton still own a substantial part of NatWest through the Government of the country. Of course, there is an argument that selling off the reaming shareholding gets the money bac to the country and reduces the fiscal pressure, but things never quite work that way. According to the NatWest Group Annual report for 2021, NatWest Group made an operating profit - £4.3bn. ,

The Chief Executive officer( CEO) and Chief Financial Officer ( CFO) were on salaries of £1,100,000 and£750,000 respectively for 2021, the report indicates that these were to increase by 2% from 1 April 2022 to £1,122,000 and £765,000.The 219 pages of NatWest Annual Report is full of catchy buzz words about “community engagement” , lifelong engagement with customers and so on it also mentions ‘Cora’ –“NatWest Group’s customer-facing AI virtual assistant, helping to provide support for customers using both our digital and telephony channels. “In Corporate speak “community “is usually whatever they want it to mean. You can read the whole report here

https://investors.natwestgroup.com/~/media/Files/R/RBS-IR-V2/annual-reports/full-annual-report.pdf

Westminster Bank, 1930s, with The District Bank on Terrace Road also visible NatWest Bank

Manchester and County Bank (becomes NatWest)

Sometime time in the 1870s – another part of the NatWest family was established in Buxton, the Manchester & County Bank in Terrace Road. The Manchester and County Bank commenced business in 1862 and three branches were opened shortly after. In 1866 the bank acquired the Saddleworth Banking Com. It had 190 branches (including Buxton) and sub-branches. When it was acquired by District Bank in 1935.Following the amalgamation, District Bank was admitted to the London Bankers' Clearing House. In 1962 District Bank itself became victim of another bank’s desire for comprehensive national coverage and it was acquired by the National Provincial Bank. District kept its separate board in Manchester until the 1968 merger of National Provincial and Westminster Bank. The District, National Provincial and Westminster banks were all fully integrated in a new firm's structure. National Westminster Bank opened its doors for business on 1 January 1970. County Bank, National Provincial and Westminster Bank all disappeared as separate entities.

The former District Bank on Terrace Road

The Mercantile Bank of Lancashire (becomes Barclays)

The Mercantile Bank of Lancashire bank was founded in 1904 and taken over by The Lancashire and Yorkshire Bank in 1904. By 1912, it is listed at 20 Spring Garden. The Lancashire and Yorkshire Bank continued on Spring Gardens for the next 60 years. It subsequently becoming Martin’s Bank. in 1969 Martins Bank was taken over by Barclays and on 4 December 1970, the Spring Gardens Branch was closed it is now the Nottingham Building Society Lancashire & Yorkshire Bank The former Martins Bank, now Nottinghamshire Building Society

The Lancashire and Yorkshire Bank, Spring Gardens

Now - the Nottingham Building Society

Union Bank of Manchester (becomes Barclays)

The last of the big Banks to arrive in Buxton was Barclays at 5, the Quadrant . The Union Bank of Manchester was founded in 1836 in King Street. In 1919, it was acquired by Barclays, becoming an ‘affiliated’ bank of the Barclays Group, and formally amalgamated in 1940. Over 140 branches were integrated into Barclays, under the control of a new Manchester Local Head Office. Barclays traced its origins back to 17 November 1690, when John Freame, a Quaker, and Thomas Gould, started trading as goldsmith bankers in Lombard Street, London. The name "Barclays" became associated with the business in 1736, when Freame's son-in-law James Barclay became a partner.[] In 1728, the bank moved to 54 Lombard Street, identified by the 'Sign of the Black Spread Eagle’. IN 1776, the firm was styled "Barclay, Bevan and Bening" and remained so until 1785, when another partner, John Tritton, who had married a Barclay, was admitted, and the business then became "Barclay, Bevan, Bening and Tritton”. In 1896, twelve houses in London and the English provinces, notably Goslings and Sharpe, Backhouse's Bank of Darlington and Gurney's Bank of Norwich (the latter two of which also had their roots in Quaker families), united to form Barclays and Co., a joint-stock bank, which at its formation held around one quarter of deposits in English private banks. Between 1905 and 1916, Barclays extended its branch network by making acquisitions of small English banks. Further expansion followed in 1918 when Barclays amalgamated with the London, Provincial and South Western Bank, and in 1919, when the British Linen Bank was acquired by Barclays.

The Union Bank (of Manchester), The Quadrant

Barclays Bank Buxton branch closed on Friday 27 August 2021, the Bank put out the usual glossy factsheet justifying the closure. Justifying their decision with declining customer numbers. They also directed customers to their Leek and Macclesfield Branches instead and various cash machines across town.

Reasons-For-Closure-Buxton (home.barclays)

In the decade before Barclays closed in Buxton, things had not really been going well for the Group. The Guardian published a useful guide to 10 years of scandals which had affected Barclays up to 2021,

Discredit history: 10 years of Barclays scandals | Barclays | The Guardian

it was by that time a long way from its English Quaker origins. These included.

2012: Financial crisis fundraising: The Serious Fraud Office launched an investigation in 2012, and eventually accused Barclays bankers of funnelling secret fees to Qatari investors in exchange for emergency funding at the height of the financial crisis in 2008. This resulted in the only criminal trial brought against UK banking executives during the financial crisis, and involved four senior bankers, all of whom were eventually found not guilty.

2012: Libor rigging scandal: Barclays was fined for manipulating the benchmark Libor interest rate in 2012, after revelations stretching back to 2005.The scandal, which engulfed a number of its global banking peers, resulted in the resignation of its chief executive, Bob Diamond.

2013: Salz review: An independent review of Barclays’ business practices urges the bank to strengthen its board, cooperate more closely with City watchdogs, and link pay more closely to the bank’s performance after discovering a “winning at all costs” culture at the lender.

2020: Staveley lawsuit ; Businesswoman Amanda Staveley took Barclays to court after learning that it had offered her Abu Dhabi client a worse deal than that it offered to Qatari investors when it was seeking emergency funding in 2008. She lost her court battle in February 2021, despite the judge finding that the bank was “guilty of serious deceit” in the way it raised money to avoid a UK government bailout at the height of the financial crisis. During that period, Barclays also suffered considerable publicity over the alleged tax avoidance operations of its Structured Capital Markets division and its Luxemburg operations The former Barclays Bank premises is now covered in scaffold, awaiting reconstruction

Endgame

In 1968/69 – there were still six national banks represented Buxton

BARCLAYS BANK LIMITED 5 The Quadrant

DISTRICT BANK LIMITED Terrace Road Higher Buxton

MARTINS BANK LIMITED 28 Spring Gardens

MIDLAND BANK LIMITED 1 The Quadrant

WESTMINSTER BANK LIMITED 2 Spring Gardens

WILLIAMS DEACON’S BANK 1 Cavendish Circus & High Street

By the 1970s , the number was down to four Barclays National Westminster Midland Williams & Glyn’s (becomes Royal Bank of Scotland) And once NatWest closes none of them will be left.

There was however some competition for joint stock banks. in the form of Savings Bank and Mutual Building societies. Trustee Savings Banks originated to accept savings deposits from those with moderate means. Their shares were not traded on the stock market but, unlike mutually held building societies, depositors had no voting rights; nor did they have the power to direct the financial and managerial goals of the organisation. Directors were appointed as trustees on a voluntary basis. The first trustee savings bank was established by Rev. Henry Duncan of Ruthwell in Dumfriesshire for his poorest parishioners with its sole purpose being to serve the local people in the community. Between 1970 and 1985, the various trustee savings banks in the United Kingdom were amalgamated into a single institution named TSB Group plc, which was floated on the London Stock Exchange. In 1995, the TSB merged with Lloyds Bank to form Lloyds TSB, at that point the largest bank in the UK by market share. In 1980, the TSB in Buxton was at 3, The Quadrant, which later became Lloyds TSB. There was it seems also a sort lived branch of Lloyds Bank in the Quadrant in the 1930s, which does not seem to have lasted past the Second World War.

Building Societies

Building societies as an institution began in late-18th century Birmingham. Many of the early building societies were based in taverns or coffeehouses, Members of a society paid a monthly subscription to a central pool of funds which was used to finance the building of houses for members, which in turn acted as collateral to attract further funding to the society, enabling further construction.[Most of the original societies were fully terminating, they were dissolved when all members had a house: In the 1830s and 1840s a new development took place with the permanent building society, where the society continued on a rolling basis, continually taking in new members as earlier ones completed purchases, these included the Leek United Building Society. The main legislative framework for the building society was the Building Societies Act 1874, In their heyday, there were hundreds of building societies: just about every town in the country had a building society named after that town. There are references to a Burbage Permanent Building Society existing in the late 19th and early 20th century, but no Buxton Building Society as such.

The 1980, Manchester South Telephone directory lists the following building societies in Buxton

Cheshire, 7 the Quadrant

Derbyshire, 12 Spring Gardens

Britannia, 28 Spring Gardens

Halifax.,2 High Street

Abbey National 73 Spring Gardens

The first three were local or regional Building Societies. Derbyshire Building Society based in Duffield, grew by absorbing a number of Derbyshire based Building Societies; Ashbourne Permanent Benefit Building Society, Somercotes Building Society and Ilkeston Permanent Building Society. By 2007, it was the 9th largest building society in the United Kingdom based on total assets of £7.1 billion It was acquired by Nationwide Building Society on 1 December 2008.

Cheshire Building Society was established in 1870 in Macclesfield, and was one of the first permanent societies. The Society was the product of multiple mergers, including the Northwich Building Society. Under similar financial stress to the Derbyshire, the Cheshire also merged with Nationwide. Commendably Nationwide Building Society remained a Mutual and is still open in Buxton, with a historic link going back to the Derbyshire and Cheshire.

The Britannia Building Society also started off fairly local being founded as the Leek & Moorlands Building Society in 1856. It expanded steadily as a regional society until the late 1950s when acquired the NALGO Building Society, and then the Westbourne Park (becoming the Leek and Westbourne); and the Eastern Counties Building Society . The Society’s name was changed to the Britannia Building Society the following year. Following the acquisition of the Bristol & West in 2005, the Britannia became the second-largest building society in the UK (based on total assets of £36.8 billion) at 31 December 2007.It merged with The Co-operative Banking Group in 2009 and was legally dissolved as a separate organisation on 1 August that year; When the Coop underwent its own Financial Crisis Many Britannia branches were instead closed, and only a small number were retained and rebranded.

The Halifax seems to have been the first Building Society to have opened a branch in Buxton. It certainly appears in directories from 1935 onwards, along with photographic evidence. Other Building societies may have operated through agents without having an established branch. The Halifax demutualised in 1997 and from there on it was downhill all the way. In May 2001 Halifax and Bank of Scotland merged to create HBOS, a “new force in banking”. By as early as January 2004 Mike Ellis, the then finance director, told the board the Financial Services Authority (FSA) is concerned the bank is an “accident waiting to happen”. In March 2008 HBOS shares collapsed on the stock market amid rumours about its financial health. City regulators launch an investigation into the share price movements. In April 2008 the ailing bank launched a £4bn cash call to bolster its capital, in July 2008, this flopped, and the big City firms underwriting it were left with all but 8% of the shares offered for sale . By August 2008 profits had plunged 70% and HBOS was caught up in the turmoil as Lehman Brothers collapsed. Lloyds TSB made a £12bn takeover offer, which the FSA said would “enhance finance stability. In November 2015 the Bank of England published a report, which laid the blame for the near collapse of the bank on its board and management, with heavy criticism of the Financial Regulators. Halifax Building Society on the Market Place 1930s . The Halifax remains open on Spring Gadens

The Halifax Building Society 1930s

Now -The Vault

By 1968, the Abbey National had a branch network of 150 and assets exceeded £1bn. In 1971, the Abbey was opening a branch per week and in 1974, the peak of the private housing boom, there were 335 branches and £3bn in assets. The Abbey National Building Society became the first of the United Kingdom building societies to demutualize and became a public limited company as Abbey National plc on 12 July 1989. On 26 July 2004, Abbey National plc and Banco Santander Central Hispano, SA announced that they had reached agreement on the terms of a recommended acquisition by Banco Santander of Abbey. As a result of the banking crisis of 2008, Abbey purchased the savings business and branches of Bradford & Bingley in September 2008 following its nationalization o by HM Government. The purchase of Alliance & Leicester by Santander had been agreed earlier that month. Although the remaining mutual building societies were not immune from the enormity of the banking crisis of 2008, they were generally less damaged than were banks in general and demutualised building societies in particular. Converted building societies proved to be more vulnerable the further they moved away from their traditional model. As argued in a leading article in TheTimes (16th June, 2008),

‘What is doubly sad is that some of the most battered banks are former building societies – those once prudent institutions woven into the fabric of British life.’

None of the demutualised institutions survived as independent institutions, and two had to be taken into state ownership. (Northern Rock and Bradford & Bingley). Mutual Building societies did not receive capital injections from the government. On the other hand, plc banks (which in theory can always seek more capital from shareholders) experienced serious capital shortages to the extent that government assistance was needed on a large scale. As a result of the financial turmoil, building society profitability was significantly lower in 2008 than in previous years, and some building societies reported large losses for the first time in many years. The Cheshire and Derbyshire sought refuge in their mergers with Nationwide. There were perhaps three main reasons why mutual did better

- Regulation limited the extent to which building societies could diversify into the areas (e.g. derivatives trading) that proved to be a serious problem for many banks.

- Mutual status meant that they generally had a lower risk appetite irrespective of regulation.

- Both by regulation and choice, building societies limited their dependence on wholesale funding markets and securitisation.

Technology

Of course, even without the hubris and the sheer incompetence which characterised the British Banks in the early 21st Century, advances in technology were always going to bring radical change to the Banking Sector.

In 1966 – Barclays launched the first debit card

In 1967 the Enfield Town branch of Barclays Bank was the first to have an automated teller machine (ATM) installed.

In 1983, customers of the Nottingham Building Society were the first to access online banking provided by the Bank of Scotland.

In 1989, First Direct, launched telephone banking in the United Kingdom pioneering the concepts of no branches and 24-hour service through a call centre.

In the 1990s, internet-only banks or "virtual banks" appeared. These banks did not have a traditional banking infrastructure, such as a branch network, a cost-saving feature that allowed many of them to offer savings accounts with higher interest rates and loans with lower interest rates than most traditional banks.

In 2011 – First Direct launches first smartphone banking app in the UK, shortly followed by Natwest.

All those combined, made it much less necessary for people to go into Bricks & Mortar bank branches and speak to people. Further developments are likely to involve the increasing use of Fintech and Artificial Intelligence.

A final word

It would be naïve not to think that Banks are in business to make a profit and that is a legitimate aspiration, if they were not in the profit-making business then they would operate, as credit unions, mutuals or building societies. The question, one might reasonably ask is “how much profit is enough”. Bank profits find their way back into the economy through dividends to pension funds and individuals. It is also fair to say that the same banks paid substantial amounts of Corporation Tax to the UK Government in the periods before the Government bailed them out. Although at least some of them while paying Corporation Taxes had also through very complex transactions and offshore structures developed several novel methods for clients not to pay tax (strictly within the letter of the law of course).

We might also consider that in the same period, part of taxes paid the good people of Buxton had been used to bail out these banks. Had the bailouts not been necessary, that money might have been better spent on health, welfare, or public services. Indeed, maybe there was a missed opportunity after the Financial Crash, with the government effectively owing huge chunks of the British Banking Sector including to something different. Perhaps towns like Buxton, would have benefitted from mutualization of failed banks or the creation of a “People’s Bank” to provide basic banking services. In the end it did not happen, the Chancellor could raise a lot of cash from selling the Government’s Bank Shares on the open market, which in the end allowed them not to increase taxes.

As a cost the total of the staff costs of all Buxton branches were probably a fraction of the executive compensation of the senior banking executives. Local bank employees get offered statutory redundancy payments or forced relocation. The big chiefs who ran rings round regulators and crashed and burned while pursuing delusion of grandeur received payoffs that the average Bank employee could not have dreamed as a price for failure. And of course, despite all the failure all the litigation and fines, none of these titans of global banking eve saw the inside of a prison cell. Instead, people who worked in local bank branches lost their jobs, because somebody had to pay for it all. From a cost point of view, the fines must be paid, so they cut costs and close branches to save money. Arguably banking is also a public service- those who suffer the most from the closures are likely to be those customers, who through age or disability may not be able to use fully automated banking services.

There of course remains one option as all the Banks like to point out in their “leaving Buxton fact sheets” , the venerable and still state-owned Post Office. When the Royal Mail was privatized, a government myth busters factsheet made it clear

“The Post Office is the nationwide network of branches offering a range of Postal, Government and Financial services. The Post Office is not for sale.”

So, for now, the Post Office is effectively acting as a state-owned bank to provide all the banking services that the national banking chains can no longer be bothered to provide in places like Buxton- the counter services, the holiday money, - basically anything where the profits were not big enough.

It is to be hoped that at least the Government keeps its word on that, and the Post Office remains around to provide branch services to all these who do not have the means or ability to travel to Leek or Macclesfield for their banking services.

Meanwhile, you can have a drink or two in The Vault or Redwillow and wander down for a very pleasant Greek meal in Ithaca and support some new local businesses while pondering on the decline and fall of Buxton's Banks and hopefully spare a few thoughts for the people who used to be employed in them and depend on them..

The Vault Buxton | The Vault Buxton | A Unique Pub in the Heart of the Marketplace in Buxton

Greek Restaurant in Buxton | Ithaca Restaurant (buxtonrestaurant.co.uk)

You can read the full story of Jane Austen's brother and his bank here